In the hospitality industry, almost everything is governed by a nationwide collective employment agreement, even the benefits and prices for occupational pensions. This is a unique situation which does not necessarily have to be accepted. The alternative solutions for senior management are particularly interesting.

Considering alternatives

As a result, most pension providers refrain from offering their services to hospitality trades. Consequently, the offering is rather one-sided: occupational pension schemes are almost exclusively managed by the two major trade associations. “The strict L-GAV requirements make sense for the average employee,” explains Joel Levi, “but they make it more difficult to find individualised solutions. Many managers would do well to check the available options and consider alternatives to the major providers.”

Tailored pension solutions

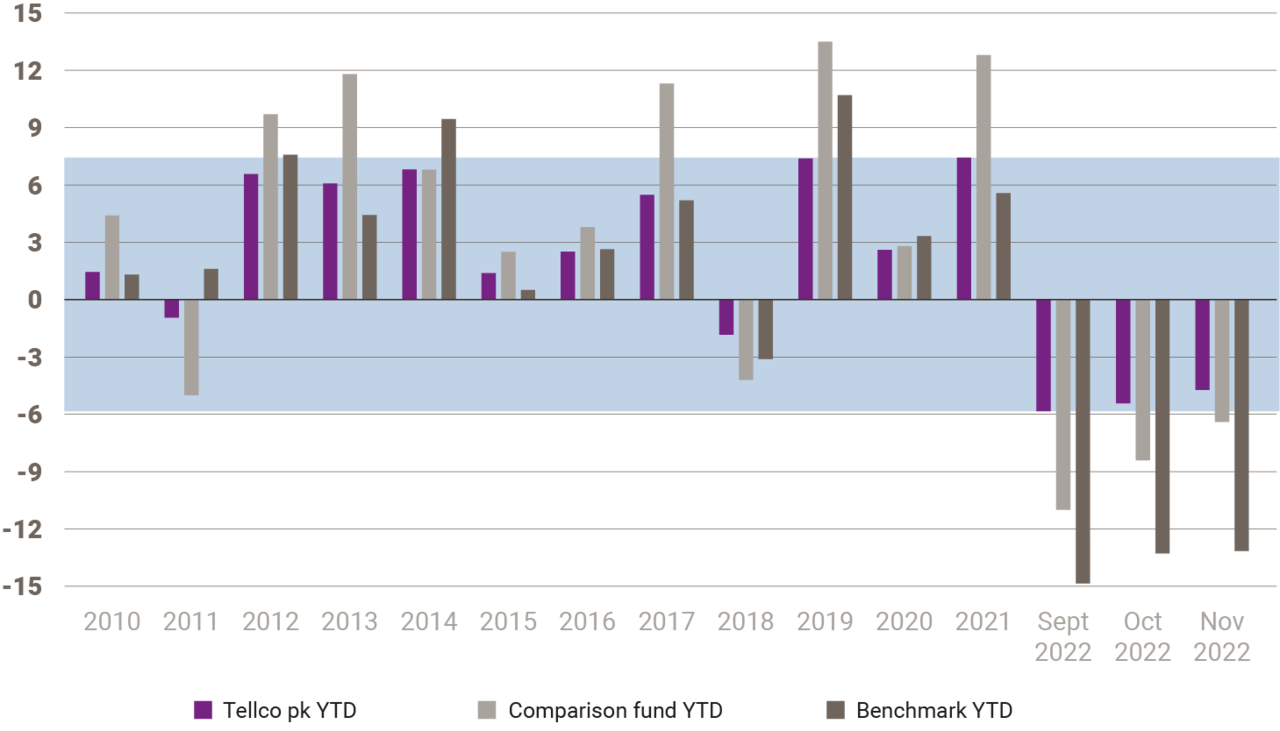

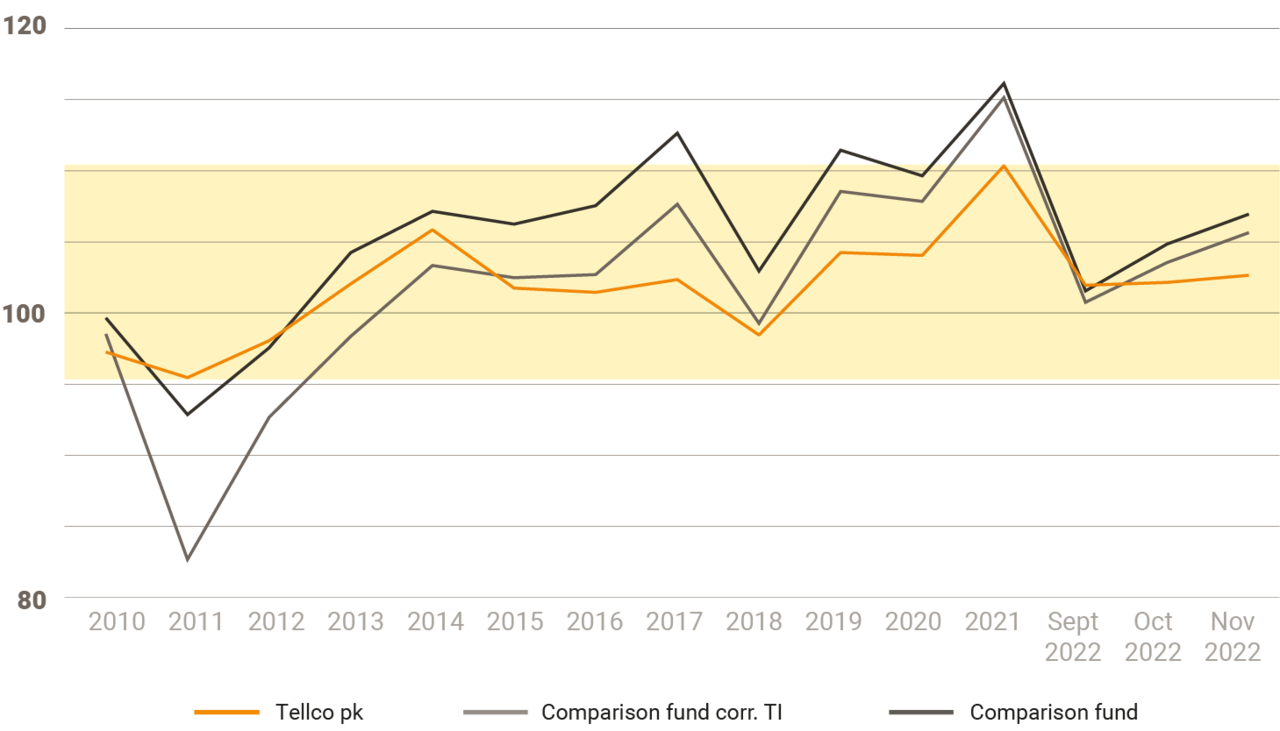

One hotel business, for example, developed a tailored pension solution together with Tellco pkPRO: the employees are insured under the provisions of the L-GAV and also enjoy additional benefits that were worked out with Tellco pkPRO. In addition, the entire senior management team has tailored pension plans. The Managing Director is convinced that this solution is a gain for all employees and makes the company a more attractive employer. It is also reassuring for him to know that his employees are properly insured.