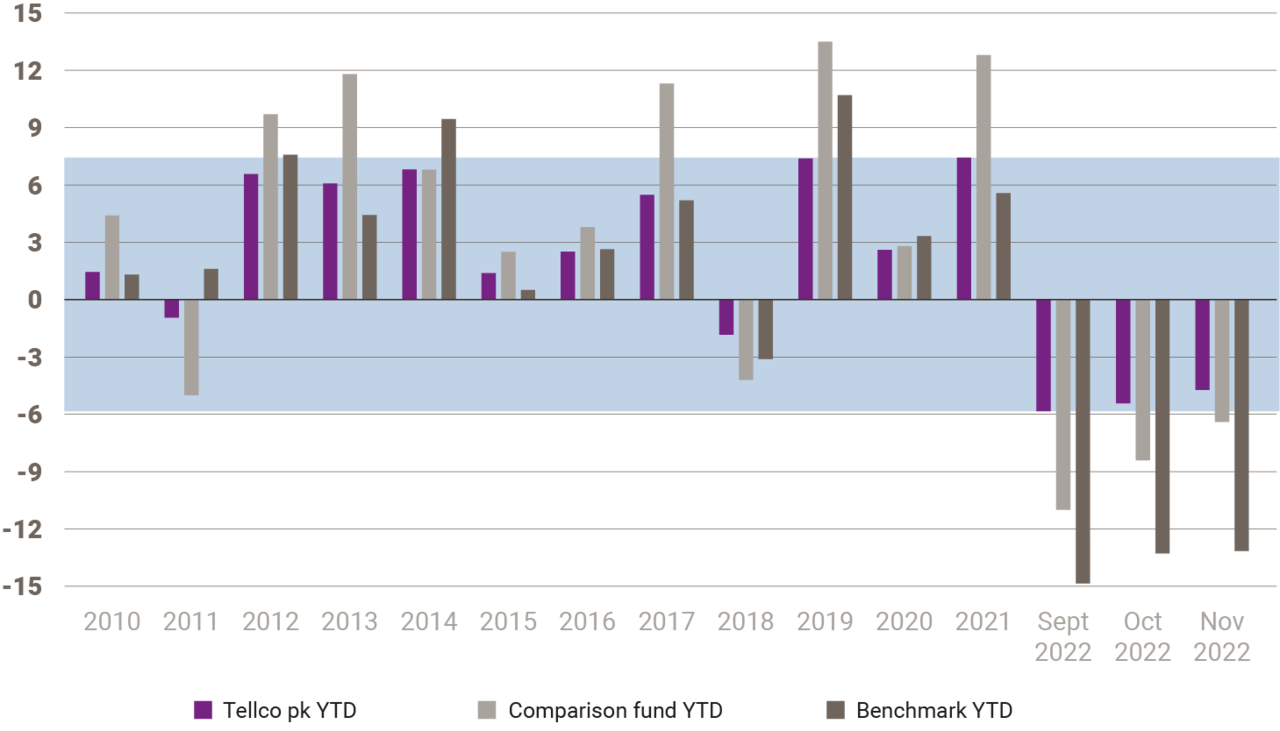

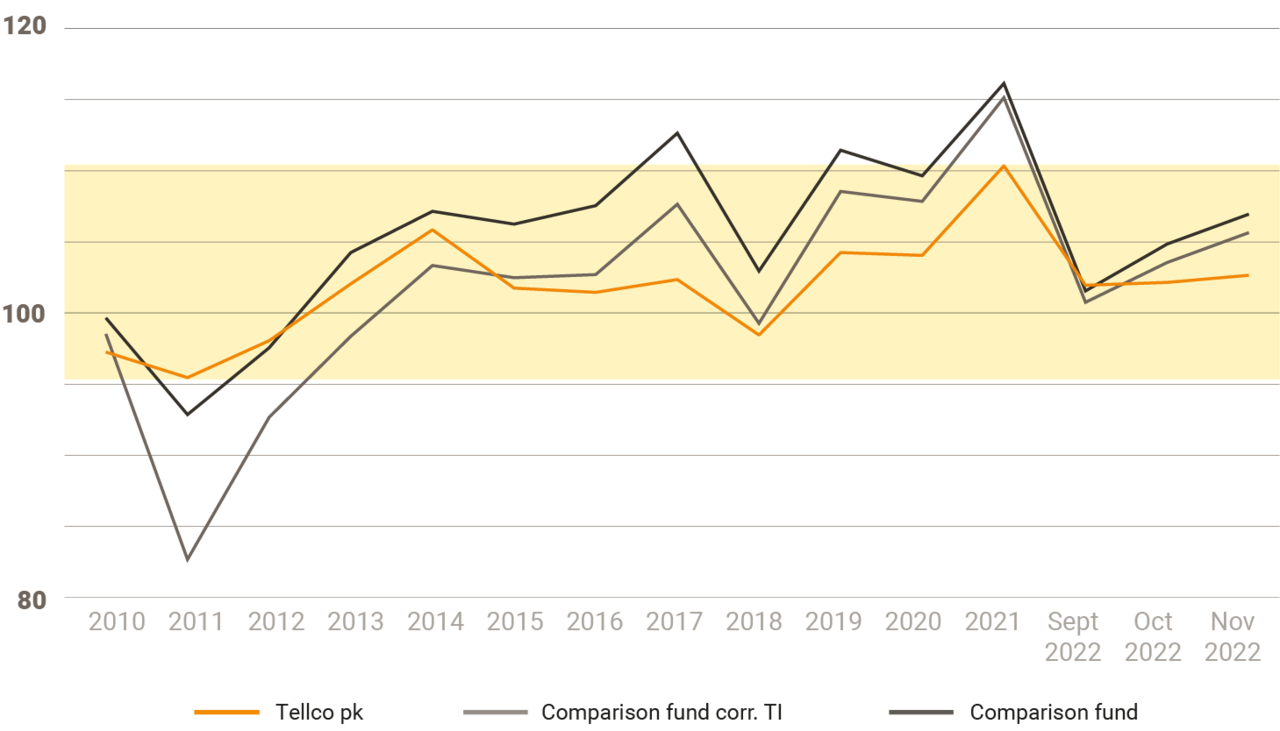

OPA minimum interest rate remains at 1 per cent: The Federal Council was informed at its meeting on 12 October 2022 that a review of the OPA minimum interest rate would be waived this year. As early as August 2022, the Federal Commission for Occupational Benefits Provision also came out in favour of maintaining the rate at 1 per cent.

The Federal Social Insurance Office informs in a release dated Wednesday, 12 October 2022, that despite the current difficult situation on the markets, maintaining the minimum interest rate of 1 per cent is justified.

The reasons for this decision included the following:

- The return on government bonds has increased significantly

- Equities and real estate showed a positive performance in 2021, but there were significant setbacks in the current year